Our Blog

Our blog publications offer our opinions, tips, and tools on a variety of topics. These articles are prepared by our consultants with specialties in compliance, quality control, staffing, training, mortgage technology, management solutions, secondary markets, loan servicing, and more.

Also, be sure to subscribe to our newsletter to get these articles and more sent directly to your inbox weekly!

Relieve Some Stress!

O.K. So you just hit the button and submitted your 2022’ HMDA LAR to the CFPB, March 1st to meet the deadline. Now what? You realize you are already two months behind in working on and reviewing your LAR data for 2023.’ Does it ever end?

Discover how you can simplify the HMDA reporting process by using SCA’s team of industry experts to integrate all aspects of the HMDA LAR. Let SCA reduce the stress and the process for your financial institution, making your LAR submission as worry-free as possible by:

SCA Service Offerings - Origination

Loan Origination Solutions

Spillane Consulting Associates’ experts have hundreds of years of collective experience in managing origination operations of various sizes around the country and we are here to put our expertise to work for your organization. We will make sure that your staff, your systems and processes, and your technology are all optimized while ensuring that all compliance regulations are satisfied at every step of the process.

Several Pool Offerings Available for Sale!

Pitchers and catchers began spring training practice this past week and before you know it, the spring market will be right around the corner. Will your institution be prepared to increase your commercial real estate or residential loan volume for your balance sheet this spring or, do you need an alternative due to the current lack of loan origination volume and low housing inventory? If so, the SCA Mortgage Exchange, a mortgage banking advisory group has several pools of loans available for bid, to fill that niche.

Mining Your Data into Gold: Keys to Building Strategy

Lenders have at their disposal an almost immeasurable amount of data. As a standard, we are forced to develop policies, processes, and procedures for securely acquiring, storing and transmitting all of this data, but one key area always seems to lag – how do you use this data to your advantage? It can be a challenge to train your mind to take this last step – or to find the time to – but once you do, the value of that output will far outweigh the cost of getting to it.

Meet the Team: Mindy Molina-O’Leary

In this series we will highlight some of the folks that keep the SCA machine moving forward and continually improving year over year to best meet our clients needs.

This week, we’d like to introduce the leader of our QC team: Mindy Molina-O’Leary, Senior QC Analyst

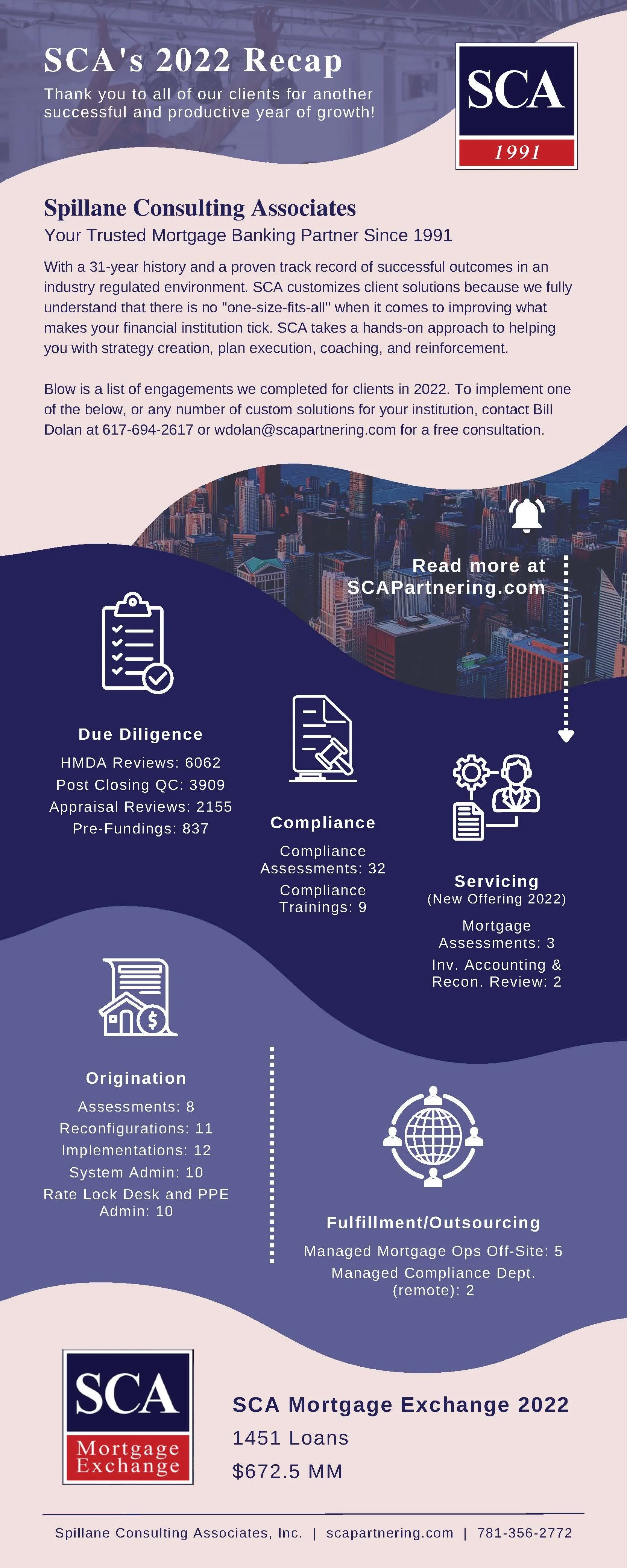

2022: Year in Numbers

Thank you to all of our clients for another successful and productive year of growth. Here are some of the engagements that we completed in 2022. Call us today for a free consultation to see how SCA can help you reach your residential lending goals in 2023.

$249.8M Pool of Fixed and Adjustable Rate Loans Available for Sale

The SCA Mortgage Exchange, a mortgage banking advisory group is pleased to present an offering of $249.8M pool of residential mortgage loan assets consisting of 496 loans. The breakdown of the pool is as follows:

111 fixed-rate loans with a UPB of $57.5M

385 adjustable rate mortgages with a UPB of $$192.3M

The WAC is 4.33% with a remaining term (WAM) of 353 months along with an original LTV of 75.02% and a DTI Ratio of 35.37%. The average FICO Score is 752.

$79.3M Pool of Manufactured Fixed Rate Loans Available for Sale

The SCA Mortgage Exchange, a mortgage banking advisory group is pleased to present an offering of $79.3M pool of single-family owner occupied residential mortgage loan assets consisting of 1312 loans. The breakdown of the pool is as follows:

The WAC is 5.624% with a remaining term (WAM) of 229 months along with an LTV of 65.41% and a DTI Ratio of 34.83. The average FICO Score is 755.

Better Take a Second Look!

For those of you who have not been following SCA’s blogs or newsletters for the past few weeks, much of our attention has focused on CRA, Fair Lending and HMDA.

Just last week, SCA posted an article highlighting a California Bank penalized by the Dept. of Justice (DOJ) to the tune of $31M for refusing to underwrite loans to predominately Black and Latino communities, the largest redlining settlement in department’s history.

This could never happen to you, right? If not, why not? Ask yourself the following questions:

Operation Teams’ Most Untapped Resource

No matter your function in a financial institution, in all likelihood you touch at least one technological platform daily- whether it is a loan origination system, a product and pricing engine, a loan interface software, a HMDA database, or your core operating system. You may have been involved in the onboarding of this software, or, as in many cases, you’ve inherited the system and all best practices for use were passed on to you like tribal knowledge. It’s not uncommon that the system(s) on which you’re operating (or the spec settings defaulted on them) outdate your tenure at the company- given the cost, time constraints, and high level of involvement it takes to change them. What’s also not uncommon is that those responsible for using these systems don’t have a full understanding of how they work and how or when to make changes to them.

Re-Tooling the Mortgage Factory. The Time to Act is NOW!

Challenging times present unique opportunities to grow and adapt while others remain stagnant. The mortgage industry is currently experiencing a significant decrease in pipeline volume. Successful lenders exploit low volume cycles by utilizing the increased internal bandwidth available to review and update current processes and implement new technology platforms.

SCA consultants are extremely familiar with the cyclical nature of the mortgage industry. We are lenders first. We have over 40 years of industry experience, and the SCA Technology group is ready to partner with you every step of the way to help you leverage technology to meet your business goals. We help you evaluate, implement, and administer solutions that meet your exact needs.

Meet the Team: Bill Dolan

In this series we will highlight some of the folks that keep the SCA machine moving forward and continually improving year over year to best meet our clients needs.

This week, we’d like to introduce a new addition to the team: Bill Dolan, CMB, AMP, Director, Business Development

Upcoming CRA Exam - Are You Prepared?

Do you know what your examiners are looking for today? Will you meet their expectations for your CRA program? Will you know how to respond when they ask what is your CRA program? At SCA, we sure know the answers to these questions and so much more!

If you want to have a successful CRA exam, you need to be prepared and know exactly what the examiners will focus on and, whether any potential fair lending violations could crop up and be identified.

What Are Your Financial Resolutions for the New Year?

Now that the holidays are behind us and the New Year has rung in, many forecasters believe that 2023’ is going to get worse before it gets better, sooooooo………do you plan on sitting back and just waiting for things to change while your competition grows? Well, snap out of it! Some of us have seen and worked through far worse times than these, so get with the program and begin accomplishing your financial resolutions NOW!

$224MM Pool of Fixed & Adjustable-Rate Mortgage Loans Available for Sale

The SCA Mortgage Exchange, a mortgage banking advisory group is pleased to present an offering of $224MM of residential mortgage loans consisting of 450 Fixed-Rate and Adjustable-Rate mortgages. The breakdown of this pool is as follows:

The WAC is 4.249% with a remaining term (WAM) of 354 months, with an LTV of 73.61% and a DTI Ratio of 34.62. The weighted average FICO Score is 753.

Small Lenders No More?

For those of you not aware of the recent technical amendment to the HMDA rule issued by the Consumer Finance Protection Bureau (CFPB), this technical amendment updates Reg C to reflect the closed-end mortgage loan threshold, pursuant to a recent court decision.

On September 23, 2022, the U.S. District Court for the District of Columbia vacated the increased loan-volume reporting threshold for closed-end mortgage loans that was in the 2020 HMDA Rule.

Meet the Team: Donna L. Thaxter

In this series we will highlight some of the folks that keep the SCA machine moving forward and continually improving year over year to best meet our clients needs.

This week, we’d like to introduce a new addition to the team: Donna L. Thaxter

Meet the Team: Robert R. Ellis

In this series we will highlight some of the folks that keep the SCA machine moving forward and continually improving year over year to best meet our clients needs.

This week, we’d like to introduce the face the head of our compliance department, Rob Ellis.

Compliant Segmentation for Mortgage Marketers

Market segmentation is a cornerstone of marketing but in the mortgage industry it can be a maze of potential compliance violations.

Marketing in the mortgage industry requires something of a recalibration for marketing personnel. In almost every other industry good marketing begins with finding out exactly who your ideal target customer is: how old they are, what nationality and race, how much income they generate, what their political affiliation are, and other variable can be very helpful metrics in the effort to make sure your marketing impressions are as impactful as possible.

Meet the Team: Paul Pouliot

In this series we will highlight some of the folks that keep the SCA machine moving forward and continually improving year over year to best meet our clients needs.

This week, we’d like to introduce the face of our Director of Sales Southwest Region and a pivotal part of the national expansion SCA is currently undergoing: Paul Pouliot, Director of Sales Southwest Reason