Week 4: Flood CMS Health Check

The Consumer Financial Protection Bureau (CFPB) issued a new report on January 13, 2025, that found significant differences in the likelihood that homeowners with a mortgage are adequately insured against flooding based both on location and on income and assets. According to the findings, over 400,000 homes may be underinsured for flooding events in the southeast and central southwestern parts of the country alone.

Homeowners in coastal areas were most likely to have flood insurance and generally had higher incomes and assets, suggesting that they were the best positioned to recover from flooding. Homeowners living near inland streams and rivers, however, were less likely to have flood insurance and less likely to have other financial resources to draw on to recover from a flood. The report uses a sample of mortgage applications from 2018-2022.

The analysis shows that the flood risk exposure of the mortgage market is more extensive and more geographically dispersed than previously understood. Homeowners can have significantly different access to insurance and therefore sharply different financial outcomes based on whether their risk of flooding comes from the coast or from inland rivers, streams, rainfall, and stormwater flooding.

The report’s findings also stated the homeowners who may be underinsured for flood risk also are likely not able to self-insure and recover from flooding. Borrowers in inland areas at risk of flooding had lower incomes and put less money down to purchase their homes compared to homeowners not in inland flood areas. This included both borrowers living in areas at high risk of coastal flooding and borrowers whose homes are not in an area of high flood risk. The report indicated that these borrowers have the fewest financial resources to recover from flooding and are most at risk of suffering catastrophic loss after a flood.

The report also indicated that current flood insurance maps may not capture accurate flood risk exposure.

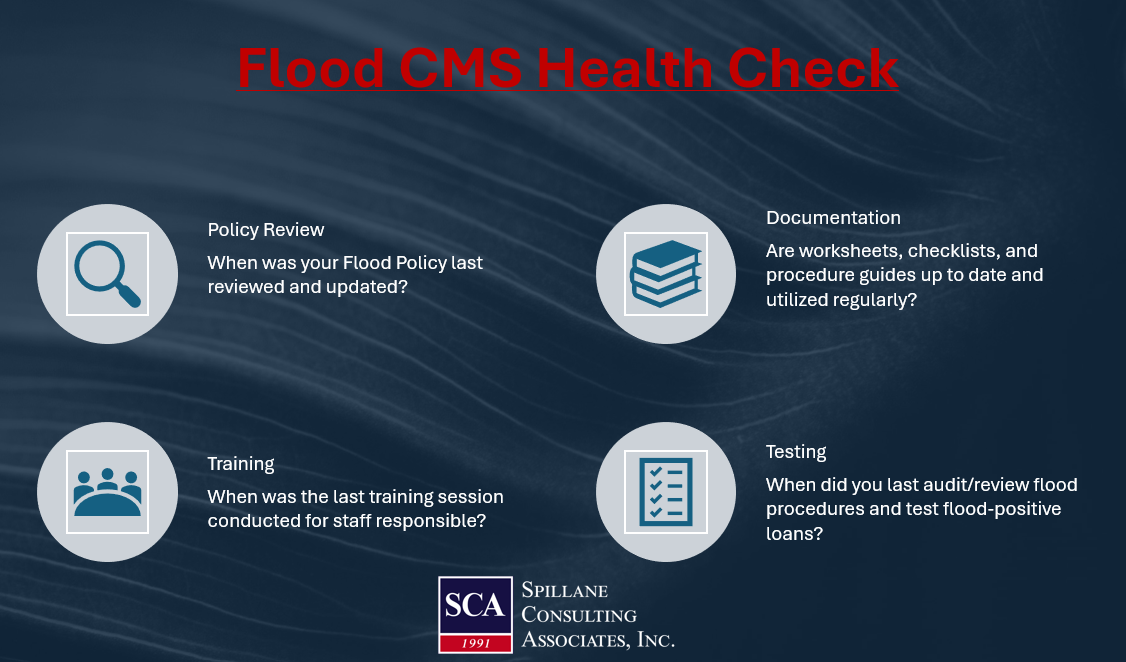

So what can you do as a lender to ensure you have proper controls in place when it comes to flood? Start with a simple CMS health check of your flood policies and procedures:

By regularly reviewing your flood policies, procedures, and training efforts, lenders can significantly reduce their exposure to flood risk and ensure compliance with all applicable regulations. For ways in which SCA can assist in this process, contact our Director, Bill Dolan, at wdolan@scapartnering.com or by phone at (617) 694-2617.

Read the full report here: CFPB Flood-Risk-and-Mortgages_Report_2025-01.pdf

Link to CFPB’s Office of Research Publication