Historical Year for Fair Lending & DOJ Referrals

Written by: Rob Ellis, Senior Compliance Consultant

2023 was a record year for the regulatory agencies referring ECOA and FHA matters to the Department of Justice. On June 26th, The CFPB released its Fair Lending Annual Report to Congress1. The report describes the CFPB’s enforcement activities against unlawful discrimination during 2023. The report also details the five bank regulatory agencies (FDIC, NCUA, FRB, OCC and CFPB) DOJ referral volume.

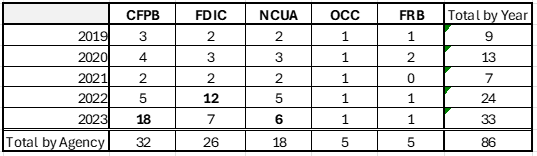

In 2023, the Department of Justice received 33 referrals involving discrimination in violation of ECOA from the five agencies. The following is a breakdown by regulator.

18 – CFPB

7 – FDIC

6 – NCUA

1 – OCC

1 – FRB

The report listed a wide variety of referral matters as well. Redlining was most prominent, however the report also listed referrals involving discrimination in:

Underwriting on the basis of receipt of public assistance income.

Credit cards on the basis of national origin and race.

Underwriting in commercial loans on the basis of race, color, national origin, and religion.

Auto loan pricing on the basis of sex or gender; and on the basis of race and national origin.

Discrimination based on age.

Discrimination based on marital status, and

Discrimination on the basis of marital status in agricultural and commercial lending.

From a historical perspective, 2023 was unprecedented. The following is a brief history of referral activities over the past five years.

In 2022, the DOJ received 24 fair lending referrals2: 12 from the FDIC, five each from the CFPB and the NCUA; and one each from the FRB and the OCC.

In 2021, the DOJ received seven ECOA and FHA lending referrals3: two each from the CFPB, the FDIC and NCUA; and one from the FRB.

In 2020, the DOJ received 13 ECOA and FHA lending referrals4: four from the CFPB, three each from the FDIC and NCUA, two from the FRB and one from the OCC

In 2019, the DOJ received nine ECOA and FHA lending referrals5: three from the CFPB, two each from the FDIC and OCC, and one each from the FRB and NCUA.

The following is a summary over the past five years of each agencies referral activity.

It is staggering the level of fair lending enforcement that has occurred over the past 2 years in the industry. It has never been more important to have a strong fair lending program.

Please contact SCA today to discuss a review of your Fair Lending program. SCA has a wide variety of fair lending consulting programs and products to fit your specific budget and needs. SCA’s products range from a quick pre-exam preparation module to completely running the fair lending program.

SCA evaluates the adequacy and thoroughness of pertinent Fair Lending CMS areas such as.

Annual Fair Lending Risk Assessment,

Audit program technical monitoring

Data analysis review that encompasses all FFIEC fair lending risk factors.

Fair Lending Committee

Fair Lending Issue Tracking

Complaint Response

Fair Lending Training

Board and management involvement

Policies and Procedures

SCA then works with our clients to implement and strengthen any weaknesses in the program. In addition, SCA also identifies, mitigates, and resolves any fair lending risks and technical violations present.

Please contact our Director, Bill Dolan, at WDolan@scapartnering.com or by phone at (617) 694-2617 and schedule a time to speak with us today.

1 Fair Lending Report of the Consumer Financial Protection Bureau 2023

2 The Attorney General's 2022 Annual Report to Congress

3 The Attorney General's 2021 Annual Report to Congress