Consumer Compliance Outlook’s Top Compliance Violation

Written by: Rob Ellis, Senior Compliance Consultant

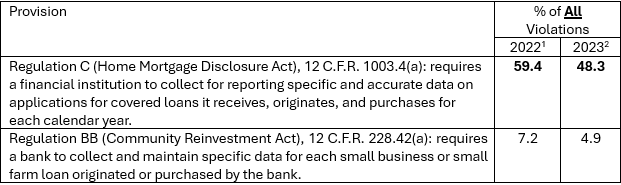

The first 2024 issue of Consumer Compliance Outlook is now available on the Federal Reserve System’s Consumer Compliance Outlook webpage. Included in this release are the top Consumer Violations in 2023 for State Member Banks. And for the second year in a row, HMDA has dominated the top spot. There’s not even a close second. These are the two most frequently cited violations in 2022 and 2023.

It’s amazing that such an overwhelming majority of all violations cited by the Federal Reserve in the past two years involved inaccurate collection of residential mortgage data. Because fair lending examinations rely, in part, on HMDA data, examiners validate this data. Thus, it is important for financial institutions subject to data collection and reporting to ensure their compliance management systems are able to meet existing and future requirements.

It could be a red flag if your current process doesn’t find errors and suggests a review of your HMDA CMS and data validation process might be prudent.

The latest issue also has articles on:

Overview of Private Flood Insurance Compliance Requirements

Consumer Compliance Requirements for Commercial Products and Services

Regulatory Calendar and more

Please contact SCA if you would like to discuss a review of your HMDA CMS and/or your current HMDA data integrity validation process. Please contact our Director, Bill Dolan, at WDolan@scapartnering.com or by phone at (617) 694-2617 and schedule a time to speak with us today.

1 https://www.consumercomplianceoutlook.org/2023/second-third-issue/top-compliance-violations/

2 The latest outlook and data on the top 2023 violations cited can be accessed here - https://www.consumercomplianceoutlook.org/