CFPB’s Eyes on Closing Costs

Recent CFPB reports focus on HMDA data and lender’s title insurance is both informative and concerning.

Written by: Rob Ellis, Senior Compliance Consultant

Over the past two months the CFPB has published two HMDA data analysis reports which details their concerns around Mortgage industry pricing and the disproportional impact on lower income borrowers, and individuals residing in Black and Hispanic communities.

On March 8, the CFPB published a blog post stating that Junk fees are driving up housing costs. The blog indicated that closing costs significantly impact a borrower’s financial commitment and, potentially, monthly payments and identified a “noticeable increase” in closing costs, with median total loan expenses on home purchase loans increasing by 21.8 percent between 2021 and 2022. In particular, the Bureau singled out title insurance fees and credit reporting fees. It labeled title insurance as a fee that borrowers are required to pay but cannot pick the provider and do not benefit from the service. The CFPB also stated “the amount that borrowers pay for lender's title insurance is often much greater than the risk.”

This coinciding with a recent Bloomberg article indicating the Consumer Financial Protection Bureau is considering a ban on charging homebuyers for lenders’ title insurance policies has caused worry in the industry.

The blog post also indicated that borrowers with smaller mortgages (i.e. lower incomes, first-time homebuyers, and individuals residing in Majority Minority communities), are often hit harder by closing costs, because they are typically fixed costs and do not change based on the size of the loan. The Bureau noted that it will continue to analyze and if necessary “issue rules and guidance to improve competition, choice, and affordability.”

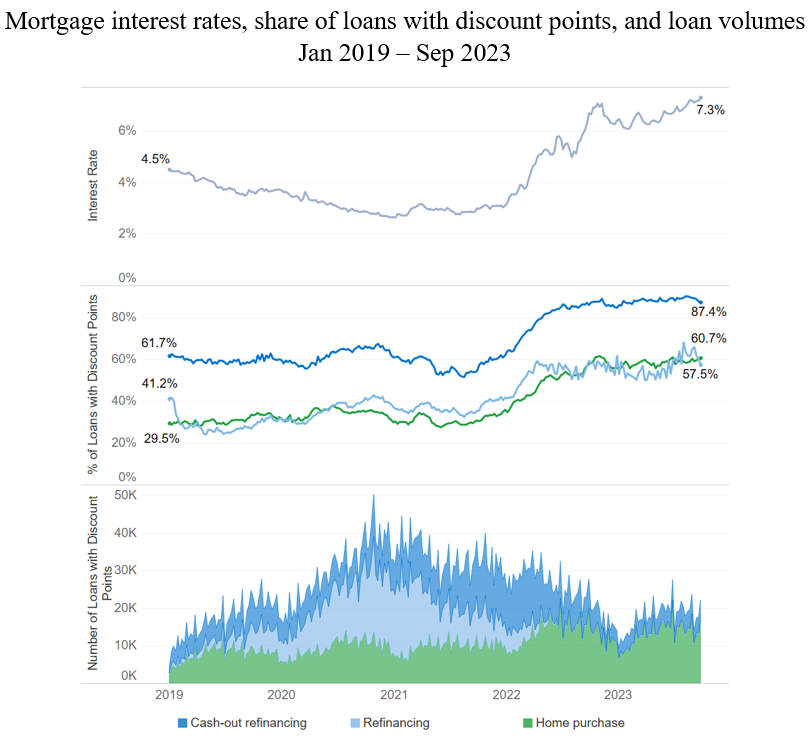

On April 5, the CFPB issued a report on the relationship between trends in discount points and interest rates. The report used HMDA data between Q1 of 2019 and Q3 of 2023 when interest rates were at “record-highs” and before the Federal Reserve announced its intention to lower interest rates. The CFPB report indicated:

The majority of recent borrowers paid discount points, including nearly 9 out of 10 borrowers with cash out refinances.

More borrowers paid discount points as interest rates increased,

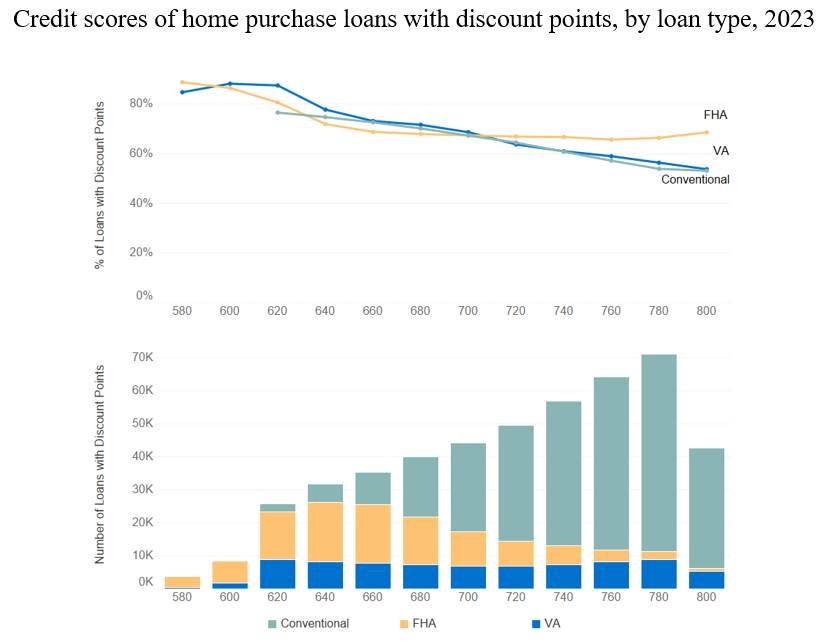

Borrowers with low credit scores were even more likely to pay discount points,

87 percent of borrowers with cash-out refinances paid discount points (up from 61 percent in 2021), and

Borrowers with cash-out refinance loans paid twice the number of discount points compared to other borrowers (with a median of 2.1 points per loan).

Additionally, almost 77 percent of FHA borrowers with a credit score below 640 paid discount points compared to 65 percent of all FHA borrowers.

The following charts represent some of the key data discussed.

The CFPB noted that considering these trends, they plan to monitor the use of discount points and weigh the advantages against the potential risks to borrowers. Stay tuned, more to come here.

One thing is certainly clear with these reports, the CFPB is definitely focusing on these items and their impact on minorities and low-income borrowers. This should be something that gets your attention as well to make sure you understand what your HMDA data is telling your regulator.

Please don’t hesitate to reach out to SCA to discuss how we can assist and support you in your HMDA data monitoring program. Please contact our Director, Bill Dolan, at WDolan@scapartnering.com or by phone at (617) 694-2617 and schedule a time to speak with us today.